The real estate market has witnessed a bustling week of activity as we stepped into the new year of 2024. As of the week ending January 6, the market has seen significant transactions in both the off-plan and ready sectors, showcasing investor confidence and a vibrant property landscape in the region. This report delves into the financials of these transactions and provides a comparative analysis of the market trends.

Off-Plan Property Transactions

Off-plan properties continue to attract a considerable amount of investment, with flats leading the charge. The total amount invested in flats reached a staggering AED 1,127,617,212.45, signifying a robust demand for apartment living and investor confidence in future residential projects. Villas, representing a more luxurious segment of the market, also saw a healthy investment inflow, with transactions totaling AED 111,191,676.00. The category labeled as H. Ap & R, which might indicate hotel apartments and residences, or a similar asset class, observed transactions amounting to AED 10,992,500.00, suggesting a niche but present interest in this type of property.

The total off-plan property transactions amounted to AED 1,249,801,388.45. This figure represents a substantial commitment by investors to properties that are yet to be completed, indicating a forward-looking optimism in the real estate market's growth potential.

Ready Property Transactions

The ready property sector, which consists of properties that are constructed and prepared for occupancy, also experienced a high volume of transactions. Flats, yet again, took the lead with transactions worth AED 938,974,321.59. This demonstrates a continued demand for immediate occupancy homes, perhaps driven by end-users looking to move into their homes without delay or by investors seeking rental income.

Villas, often seen as a benchmark for luxury residential property investments, saw transactions reach AED 271,112,098.15. The transaction volume in this category highlights a sustained interest in premium housing options. Hotel apartments and residences or similar properties categorized as H. Ap & R recorded transactions amounting to AED 67,551,569.28, underlining a consistent yet smaller segment of the market focusing on hospitality or residence services.

The total transactions for ready properties were AED 1,277,637,989.02, slightly surpassing the off-plan sector, which could signal a market preference for tangible, immediate assets.

Comparative Analysis

The comparative analysis of off-plan and ready property transactions reveals several market insights. While the total investment in ready properties slightly exceeded that of off-plan properties, the difference was not substantial, which suggests a balanced market with opportunities across both sectors.

The dominance of flats in both categories underscores a trend towards apartment living, possibly driven by urbanization, the appeal of community amenities, and the convenience of apartment living in metropolitan areas. The investment in villas, while significantly lower than flats, still reflects a strong market segment for luxury and spacious living.

The smaller figures for H. Ap & R in both sectors may indicate a niche market with specialized demand, potentially linked to tourism or business travel that calls for short to medium-term accommodation with additional services.

Off-Plan Sector: Top 10 Areas by Value

Al Wasl Leads Robustly

Al Wasl tops the chart with transactions valued at AED 187,908,000.00, signifying a high desirability for properties in this area. Its central location and premium lifestyle offerings may contribute to this high valuation.

Diversity of Investment

The diversity in the areas of investment suggests a broad base of confidence across different parts of the city. Notable entries include Hadaeq Sheikh Mohammed Bin Rashid with AED 114,103,188.00, showing an affinity for new, upscale developments.

Iconic Burj Khalifa

The iconic Burj Khalifa area continues to attract significant investment, totaling AED 79,498,625.87, underscoring its everlasting appeal as a premium real estate hotspot.

TECOM and Marsa Dubai

Emerging areas such as TECOM SITE A and Marsa Dubai, with investments of AED 74,614,000.00 and AED 71,342,810.41 respectively, reflect a trend towards new growth corridors in the city.

Total Transactions

The total transaction value in the top 10 off-plan areas reached an impressive AED 822,916,544.74, indicating a vibrant market for new developments and investor readiness to capitalize on future growth.

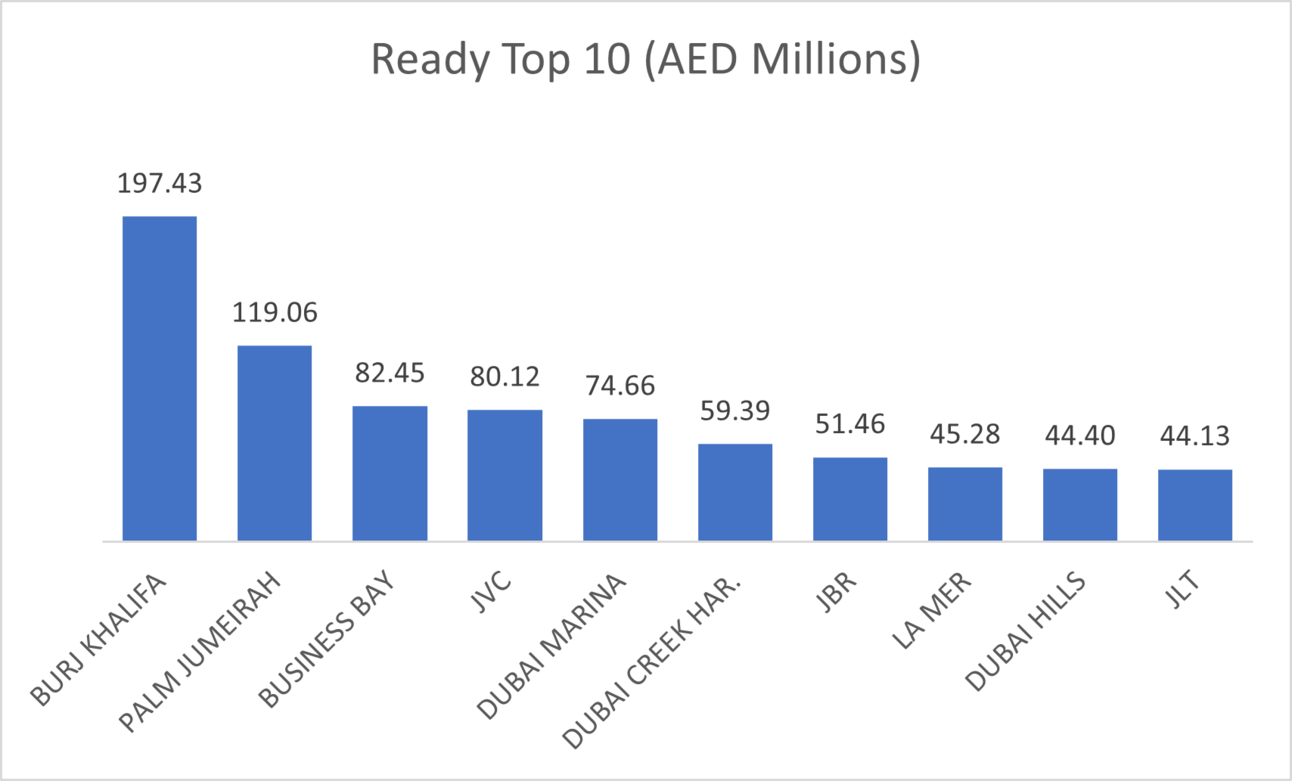

Ready Sector: Top 10 Areas by Value

Burj Khalifa Dominates

In the ready sector, the Burj Khalifa area stands out with a transaction value of AED 197,430,858.43, reinforcing its status as a sought-after location for ready-to-move-in properties.

Palm Jumeirah's Luxurious Appeal

Palm Jumeirah comes in second with AED 119,058,206.61, reflecting the ongoing allure of beachfront living and the prestige associated with the area.

Business Bay's Strategic Significance

Business Bay's strategic position as a commercial and residential hub is evident with transactions worth AED 82,446,335.58, illustrating its role as a pivotal area in the real estate market.

JVC and Dubai Marina

Jumeirah Village Circle (JVC) and Dubai Marina also feature prominently, with values of AED 80,121,145.16 and AED 74,661,274.33, highlighting the consumer preference for well-established communities with comprehensive amenities.

Total Transactions

The ready property sector's top 10 areas amassed a total value of AED 798,381,618.98, which, although slightly lower than the off-plan sector, showcases strong market activity for completed properties.

The real estate market has shown healthy activity levels in the first week of 2024, with a balanced interest in both off-plan and ready properties. The significant investments in flats across both sectors highlight a trend towards this type of living space, while the steady figures for villas and hotel apartments suggest niche markets with their own dedicated investor bases.

As the year progresses, these trends will be essential to watch, providing insights into consumer preferences and investor confidence within the real estate sector. The data from this week will serve as a benchmark for future analyses and could indicate the beginning of a promising year for the real estate market.

Data Source: Dubai Land Department