Total trading reached AED 14.11B across 5,481 transactions in Week 7. That’s up from last week’s AED 11.79B and 4,699 transactions, a +AED 2.33B (+19.7%) jump in value and +782 (+16.6%) more deals.

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flat | 4,948.4 | 2,784.0 |

Villa | 1,342.4 | 700.3 |

Hotel Apt. & Rooms | 74.2 | 132.5 |

Commercials | 556.2 | 298.9 |

Total | 6,921.2 | 7,189.2 |

Without the outlier, Ready would be AED 3,915.7M

Off-Plan Market Performance

Total Value: AED 6,921.2M

Share of Weekly Total: 49.1%

Off-Plan Sub-Category | Value (AED millions) | % of Off-Plan |

|---|---|---|

Flat | 4,948.4 | 71.5% |

Villa | 1,342.4 | 19.4% |

Hotel Apt. & Rooms | 74.2 | 1.1% |

Commercials | 556.2 | 8.0% |

Top Performing Off-Plan Areas

Top 10 off-plan areas total AED 3,854.5M (55.7% of Off-Plan).

Off-Plan Area | Value (AED millions) | % Of Off-Plan |

|---|---|---|

Al Yelayiss 1 | 985.8 | 14.2% |

Al Wasl | 490.7 | 7.1% |

Dubai Islands | 483.5 | 7.0% |

Madinat Al Mataar | 347.1 | 5.0% |

Business Bay | 303.8 | 4.4% |

Ready Market Performance

Total Value: AED 7,189.2M

Share of Weekly Total: 50.9%

Ready Sub-Category | Value (AED millions) | % of Ready |

|---|---|---|

Flat | 2,784.0 | 38.7% |

Villa | 700.3 | 9.7% |

Hotel Apt. & Rooms | 132.5 | 1.8% |

Commercials | 298.9 | 4.2% |

It’s important to nitice that 3 sized partition transactions (all in Fairmont Hotel & Resort, 2 grants and 1 mortgage) in Palm Jumeirah printed AED 3,273.4M, which is why Ready beats Off-Plan this week.

With the outlier included: Ready = 50.9% of the week.

Without the outlier: Ready would be AED 3,915.7M, and the split flips to Off-Plan 63.9% vs Ready 36.1%.

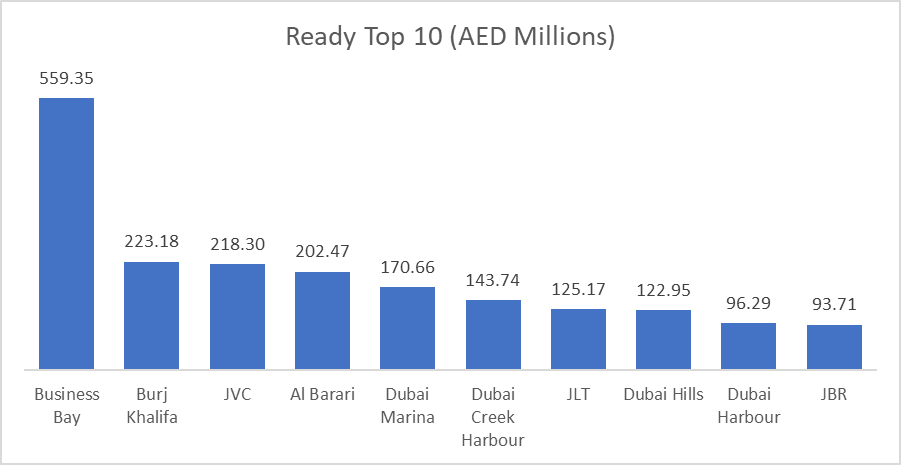

Top Performing Ready Areas

Ready Top 10 total is AED 1,955.8M. That Top 10 list is 27.2% of total Ready value. The Palm Jumeirah outlier (AED 3,273.4M) is not included.

Ready Area | Value (AED millions) | % Of Ready |

|---|---|---|

Business Bay | 559.4 | 7.8% |

Burj Khalifa | 223.2 | 3.1% |

JVC | 218.3 | 3.0% |

Al Barari | 202.5 | 2.8% |

Dubai Marina | 170.7 | 2.4% |

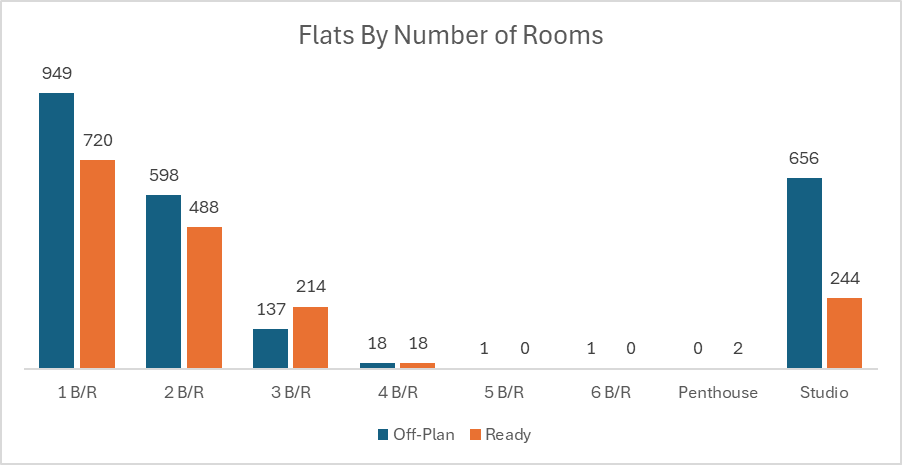

On The Micro Level

Weekly Comparison

Metric | Last Week | This Week | Change |

|---|---|---|---|

Total Value (AED) | 11.79B | 14.11B | +2.33B (+19.7%) |

Transactions | 4,699 | 5,481 | +782 (+16.6%) |

Market Insights & Outlook

Week 7 looks like a higher-activity week on both value and volume, but the headline ready-market lead is largely driven by a Palm Jumeirah outlier. Under the surface, the market’s “normal engine” remains intact: off-plan is still apartment-led at scale, while the ready market shows its typical pattern of central-district liquidity (Business Bay) plus prime and established communities (Burj Khalifa, Dubai Marina, Dubai Hills). If the coming weeks revert without similar mega-deals, expect the split to lean back toward the more familiar off-plan-led profile.

Data Source: Dubai Land Department