Get home insurance that protects what you need

Standard home insurance doesn’t cover everything—floods, earthquakes, or coverage for valuable items like jewelry and art often require separate policies or endorsements. Switching over to a more customizable policy ensures you’re paying for what you really need. Use Money’s home insurance tool to find the right coverage for you.

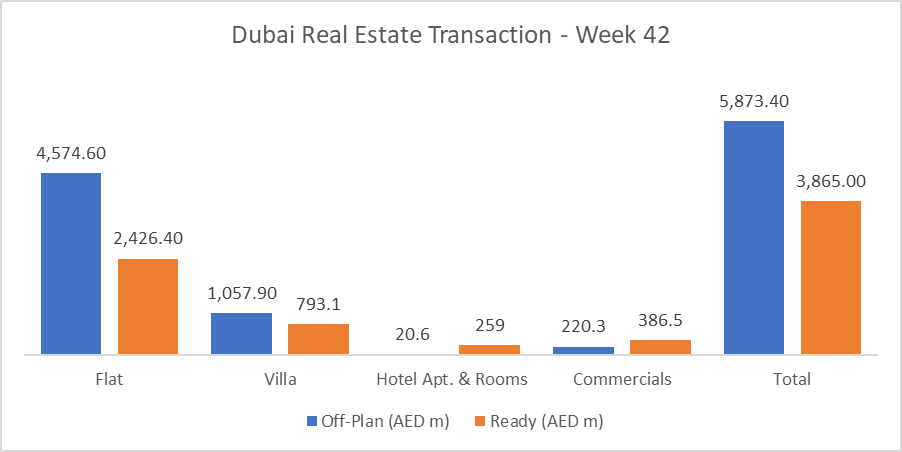

In week 42, the total trading reached AED 9.74 billion across 4,760 transactions. ~1% decline in value and 3% decrease in number of transactions from last week’s numbers. Off-plan contributed AED 5.87 billion (60.3%), while Ready accounted for AED 3.86 billion (39.7%).

Category | Off-Plan (AED million) | Ready (AED million) |

|---|---|---|

Flat | 4,574.6 | 2,426.4 |

Villa | 1,057.9 | 793.1 |

Hotel Apt. & Rooms | 20.6 | 259.0 |

Commercials | 220.3 | 386.5 |

Total | 5,873.4 | 3,865.0 |

Off-Plan Market Performance

Total Value: AED 5.87 bn

Share of Weekly Total: 60.3%

Flat: AED 4.57 bn (77.9% of Off-Plan)

Villa: AED 1.06 bn (18.0% of Off-Plan)

Hotel Apt. & Rooms: AED 20.6 m (0.4% of Off-Plan)

Commercials: AED 220.3 m (3.8% of Off-Plan)

Off-plan momentum stayed flat-led, with apartments delivering nearly 78% of off-plan value; villas added a further 18%, while commercial and hospitality remained niche.

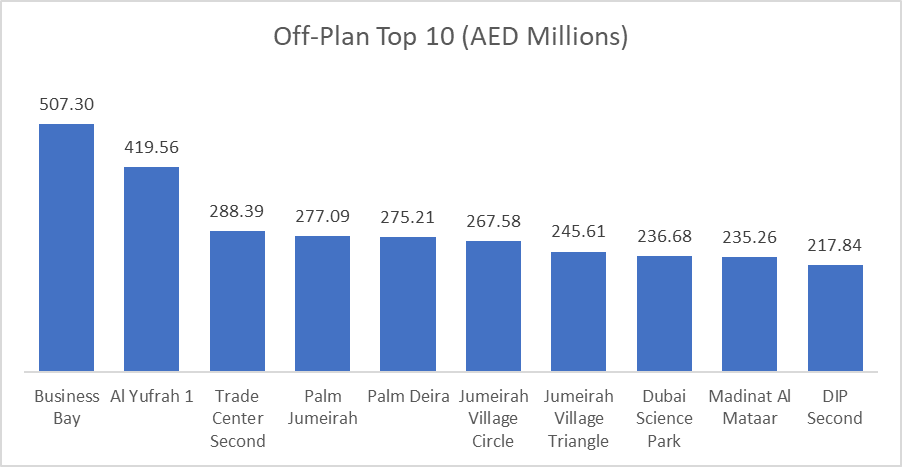

Top Performing Off-Plan Areas (by value)

Area | Value (AED m) |

|---|---|

Business Bay | 507.3 |

Al Yufrah 1 | 419.6 |

Trade Center Second | 288.4 |

Palm Jumeirah | 277.1 |

Palm Deira | 275.2 |

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Ready Market Performance

Total Value: AED 3.86 bn

Share of Weekly Total: 39.7%

Flat: AED 2.43 bn (62.8% of Ready)

Villa: AED 793.1 m (20.5% of Ready)

Hotel Apt. & Rooms: AED 259.0 m (6.7% of Ready)

Commercials: AED 386.5 m (10.0% of Ready)

Ready transactions were dominated by apartments (63%) with steady villa activity (~21%); commercial deals contributed a notable 10%, indicating healthy end-user and investor demand.

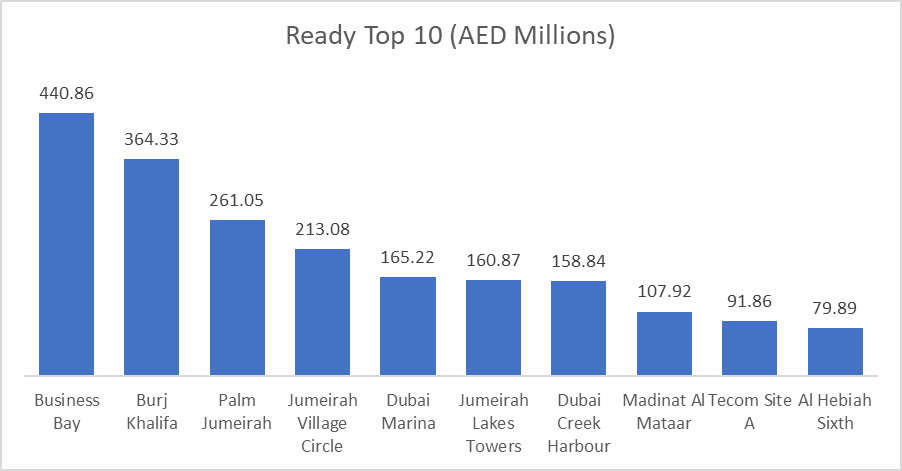

Top Performing Ready Areas (by value)

Area | Value (AED m) |

|---|---|

Business Bay | 440.9 |

Burj Khalifa | 364.3 |

Palm Jumeirah | 261.1 |

Jumeirah Village Circle | 213.1 |

Dubai Marina | 165.2 |

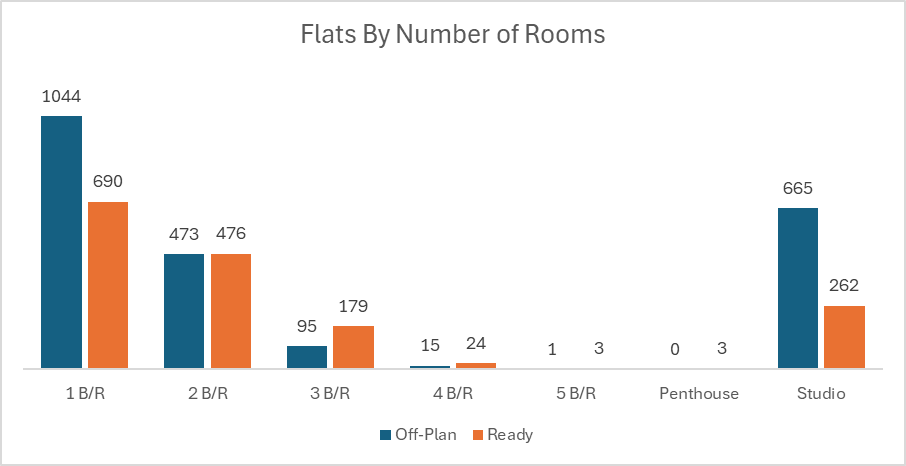

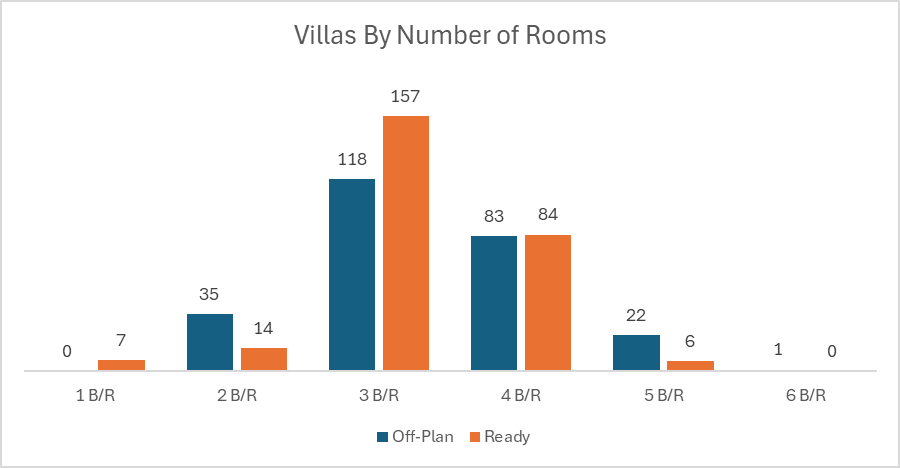

On the micro level

Below is the sales distribution based on the number of bedrooms

Weekly Comparison

Metric | Last Week | This Week | Change |

|---|---|---|---|

Total Volume | AED 9.82 bn | AED 9.74 bn | −0.8% |

Number of Transactions | 4,932 | 4,760 | −3.5% |

Market Insights & Outlook

Liquidity eased marginally week-on-week (−0.8%), with activity counts also softer (−3.5%). The demand mix remains apartment-heavy across both Off-Plan (78% of segment value) and Ready (63%), while Business Bay led value traded in both segments, signaling persistent core-CBD appeal. Watch for continued depth in waterfront and Downtown-adjacent submarkets (Palm, Burj Khalifa, Creek Harbour) as developers time end-of-year launches and buyers lock pricing ahead of potential 2026 handovers.

Data Source: Dubai Land Department