Dubai’s property market continued its upward trajectory in Week 11 of 2025, recording total real estate transactions valued at AED 8.35 billion, a slight (1.2%) but positive increase from AED 8.2 billion in Week 10. This reflects the market’s resilience and sustained investor confidence across both Off-Plan and Ready segments.

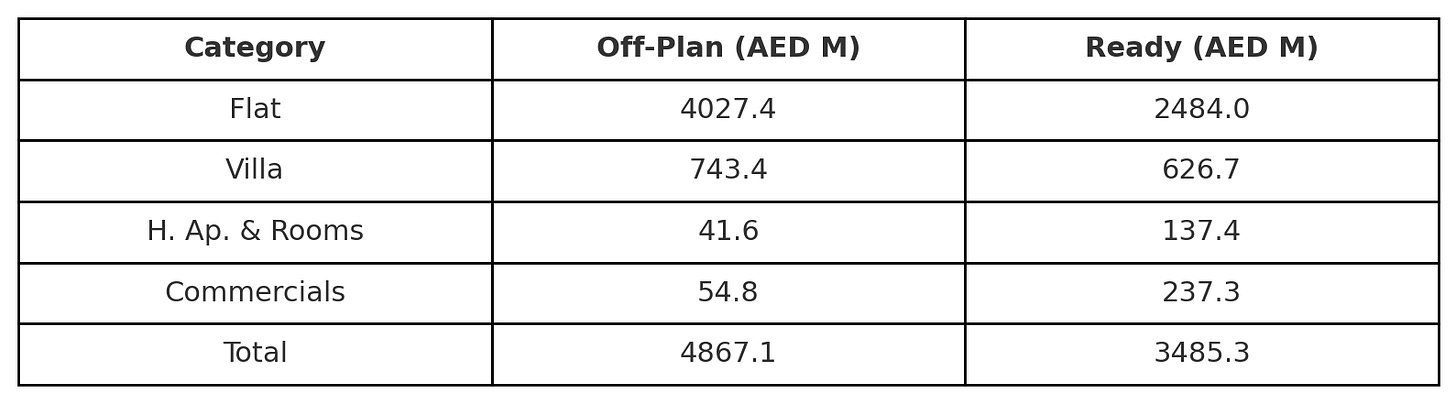

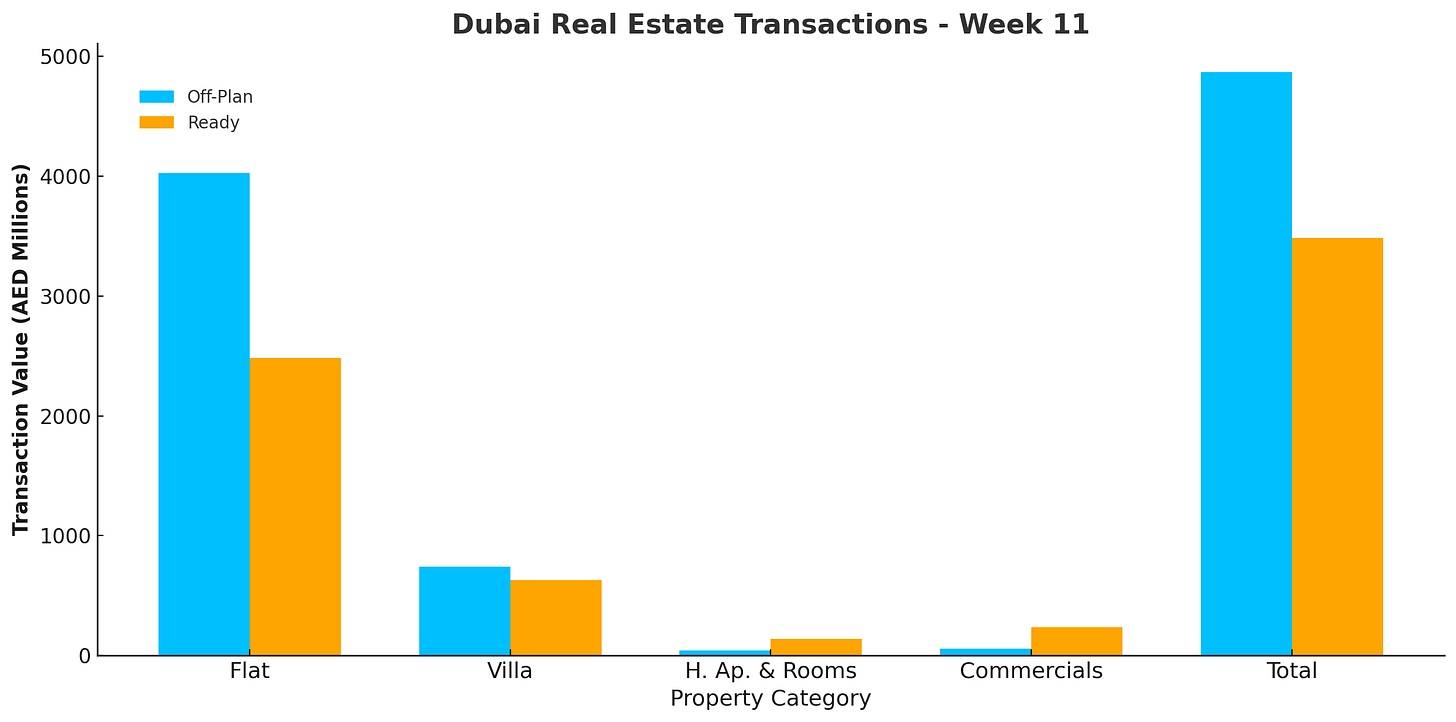

Breakdown by Property Type

1- Off-Plan Transactions

Off-Plan properties dominated the market once again, contributing AED 4.87 billion, which accounts for 58.3% of the total weekly transactions.

Subcategory Contributions to Off-Plan Total:

Flats: AED 4.03B (82.7% of Off-Plan)

Villas: AED 743.4M (15.3%)

Hotel Apartments & Rooms: AED 41.6M (0.9%)

Commercials: AED 54.8M (1.1%)

The clear preference for Off-Plan Flats signals strong investor interest in future-ready living spaces, particularly in lifestyle-centric communities.

Top Performing Areas by Value

The Off-Plan segment was led by strong activity in newer and developing zones. The top 10 areas alone accounted for AED 2.92 billion, or roughly 60% of total Off-Plan value.

Palm Deira – AED 468.2M

Madinat Al Mataar – AED 429.9M

Business Bay – AED 331.5M

Marsa Dubai – AED 319.8M

Wadi Al Safa 5 – AED 279.4M

Palm Deira and Madinat Al Mataar emerged as leading destinations for off-plan investments, benefiting from large-scale master plans and strategic positioning

2- Ready Transactions

Ready properties followed closely, with AED 3.49 billion in transactions, representing 41.7% of the weekly total.

Subcategory Contributions to Ready Total:

Flats: AED 2.48B (71.3% of Ready)

Villas: AED 626.7M (18.0%)

Hotel Apartments & Rooms: AED 137.4M (3.9%)

Commercials: AED 237.3M (6.8%)

While Ready Flats maintain dominance, the rise in commercial property transactions indicates growing business activity and demand for operational spaces.

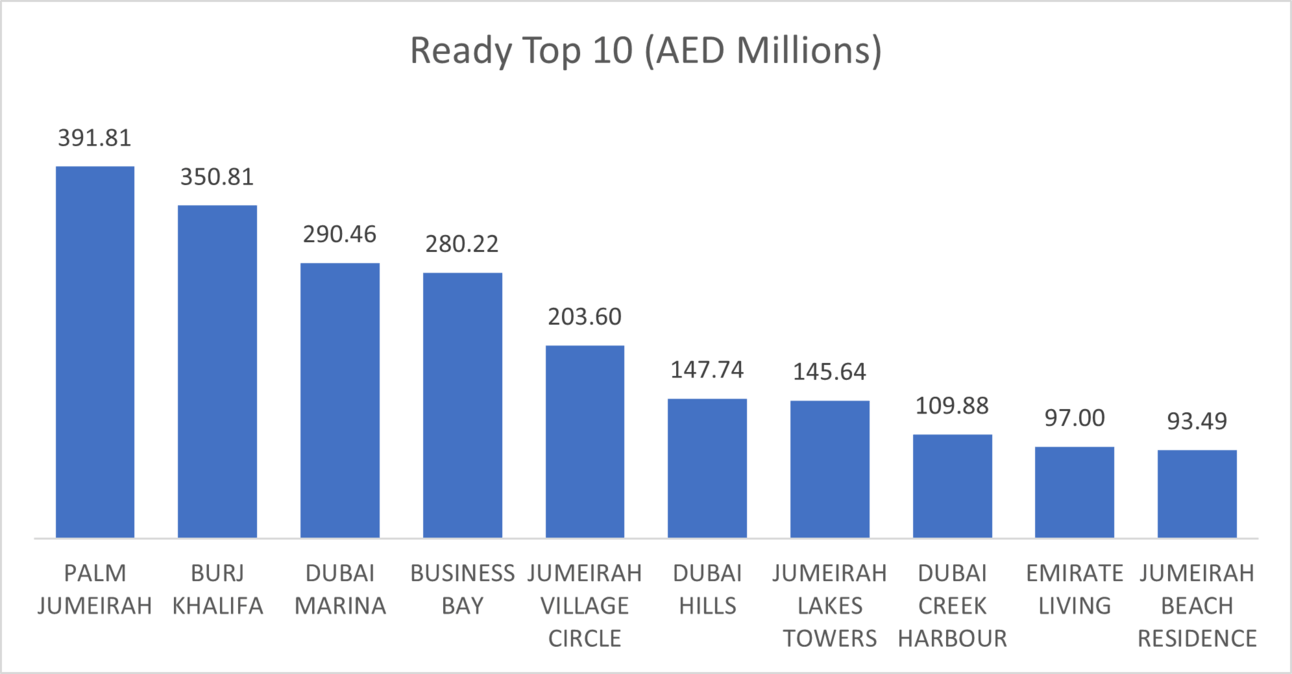

Top Performing Areas by Value

The Ready market saw continued investor confidence in established luxury neighborhoods, with the top 10 areas totaling AED 2.11 billion, nearly 61% of Ready transactions.

Palm Jumeirah – AED 391.8M

Burj Khalifa – AED 350.8M

Dubai Marina – AED 290.5M

Business Bay – AED 280.2M

Jumeirah Village Circle – AED 203.6M

Palm Jumeirah led Ready transactions, reinforcing its status as a top-tier luxury address, followed closely by Burj Khalifa and Dubai Marina, which continue to attract both end-users and investors.

Conclusion

Dubai’s Week 11 real estate activity reaffirms the city’s strong market fundamentals. Off-Plan properties continue to lead, driven by developer offerings in emerging communities, while Ready properties in prime locations hold strong investor appeal. As the market heads deeper into Q1, all indicators point toward a healthy, active property sector with diversified interest across asset types.

Data Source: Dubai Land Department