There has been a significant decrease in the total of real estate transactions, with a drop of AED 1,475,101,459, representing a 17.1% decrease from the previous week.

The real estate market has experienced a varied week-over-week performance. While the total number of transactions has decreased, the ready properties market has shown resilience and growth, especially in flats and villas. The off-plan market faced a downturn.

Current Week Summary:

Total Transactions: AED 7,141,036,133

Off-Plan Transactions:

Flats: AED 3,670,284,841

Villas: AED 352,885,734

Hotel Apartments & Rooms: AED 107,484,812

Off-Plan Total: AED 4,149,964,261

Ready Properties Transactions:

Flats: AED 2,085,992,573.27

Villas: AED 564,941,758.70

Hotel Apartments & Rooms: AED 104,981,755.30

Ready Total: AED 2,991,071,872.71

Week-Over-Week Comparative Analysis:

Total Transactions: There has been a significant decrease in the total of real estate transactions, with a drop of AED 1,475,101,459, representing a 17.1% decrease from the previous week.

Off-Plan Transactions:

Flats: The current week saw a considerable decrease of AED 1,595,365,195 in transactions for off-plan flats, a 30.3% decrease.

Villas: Off-plan villa transactions have also decreased by AED 164,466,497, a 31.8% decrease.

Hotel Apartments & Rooms: This segment, however, saw an increase of AED 50,992,811, an upsurge of 90.3%.

The overall off-plan market contracted by AED 1,733,359,136, a 29.5% decrease.

Ready Properties Transactions:

Flats: There was an increase of AED 210,826,714.17 in transactions for ready flats, a 11.2% increase.

Villas: Ready villa transactions have risen by AED 118,067,789.09, a 26.4% increase.

Hotel Apartments & Rooms: There was a decrease in this category by AED 45,617,776.12, a 30.3% decrease.

The total transactions for ready properties show an increase of AED 258,258,677.80, up by 9.5%.

Market Dynamics:

The off-plan market has seen a larger contraction compared to the ready property market, which has increased in transaction volume over the past week.

The most notable increase in activity was in the ready flats and villas segment, suggesting a stronger demand for immediate occupancy properties.

The hotel apartments and rooms market showed volatility, with off-plan transactions more than doubling and ready transactions seeing a significant decrease.

Analysis of Real Estate Transactions by Area

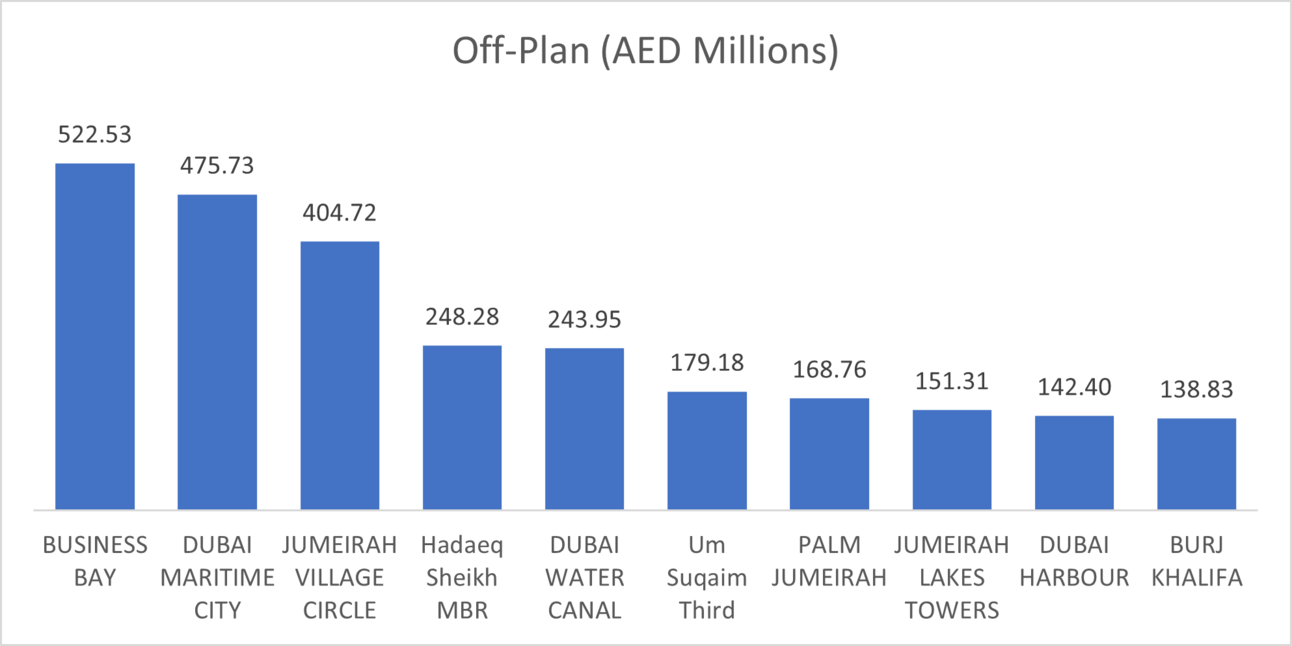

Off-Plan Property Hotspots:

BUSINESS BAY: Tops the chart for off-plan transactions with a staggering AED 522,527,645, highlighting its status as a prime location for investors seeking new development opportunities.

DUBAI MARITIME CITY: Follows closely with AED 475,728,408 in transactions, suggesting a growing interest in waterfront properties and perhaps new developments in the area.

JUMEIRAH VILLAGE CIRCLE: With transactions worth AED 404,720,226, this area continues to attract investment, likely due to its strategic location and community-focused living environments.

Other notable areas like Hadaeq Sheikh MBR and DUBAI WATER CANAL also saw substantial investments of over AED 200 million each, indicating their rising popularity.

PALM JUMEIRAH and BURJ KHALIFA, despite their iconic statuses, saw relatively lower transactions in off-plan properties, which might indicate market maturity or a pivot towards ready properties in these locations.

The total off-plan transaction value in the analyzed areas amounted to AED 2,675,676,109.

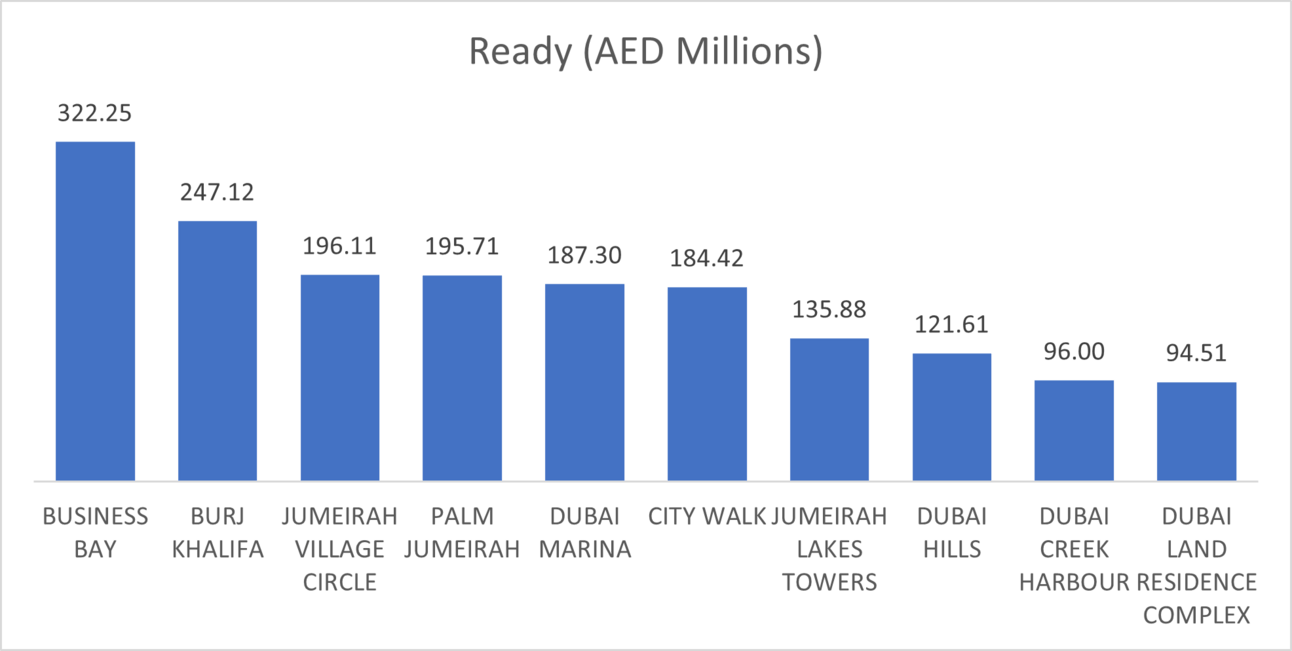

Ready Property Hotspots:

BUSINESS BAY again takes the lead but with a lower figure of AED 322,247,904 for ready properties, reinforcing its position as a sought-after district for both new developments and completed units.

BURJ KHALIFA area shows a strong performance in the ready property segment with AED 247,119,048, possibly due to the prestige and high demand for properties in this iconic location.

JUMEIRAH VILLAGE CIRCLE and PALM JUMEIRAH also featured prominently, with close to AED 200 million in transactions each, suggesting a balanced demand for both off-plan and ready properties.

DUBAI MARINA and CITY WALK show healthy activity, likely driven by their popularity as residential and lifestyle destinations.

The more suburban areas like DUBAI HILLS and DUBAI CREEK HARBOUR indicate growing transactions, suggesting an expansion of the real estate market beyond the central areas of Dubai.

The total transaction value for ready properties in these areas reached AED 1,780,899,209.

Comparative Insights:

BUSINESS BAY is the most active area for both off-plan and ready property transactions, indicating its robust market dynamics.

There is a notable variation in the transaction values between off-plan and ready properties, with off-plan generally seeing higher values. This could be reflective of a current investor preference for newer developments.

Iconic locations such as BURJ KHALIFA and PALM JUMEIRAH show more transactions in ready properties compared to off-plan, possibly due to limited new developments or a preference for the existing luxury property stock.

The data suggests a geographical spread of investments with central, coastal, and suburban areas all seeing significant transactions, indicating a diverse real estate market catering to a variety of buyers and investors.

In conclusion, the real estate market in Dubai continues to show dynamism with a mix of central and suburban areas attracting significant investments. BUSINESS BAY's dominance in both the off-plan and ready property transactions underscores its central role in the Dubai real estate market. The spread of transactions across various districts reflects a market with diverse offerings and buyer preferences. The current trend also indicates a possible investor inclination towards off-plan properties, suggesting confidence in future market growth. However, the consistent demand for ready properties in well-established areas points towards a sustained interest in immediate occupancy homes, especially in iconic and luxury segments.

Data Source: Dubai Land Department