In the week ending on the 8th of March, the Dubai real estate market observed considerable transactions totaling AED 7,122,709,698. Analysis of the market composition reveals a notable distinction between off-plan and ready property transactions.

Off-Plan Transactions:

The off-plan property segment accounted for AED 4,017,006,155, which is approximately 56.4% of the total weekly transactions. This segment was dominated by flat sales, contributing an impressive AED 3,209,889,894, or roughly 80% of the off-plan total. Villas followed with a significant but lesser amount of AED 722,035,752, constituting about 18% of the off-plan transactions. Hotel apartments and rooms options represented the smallest portion, with AED 55,675,389, accounting for approximately 1.4% of the off-plan segment.

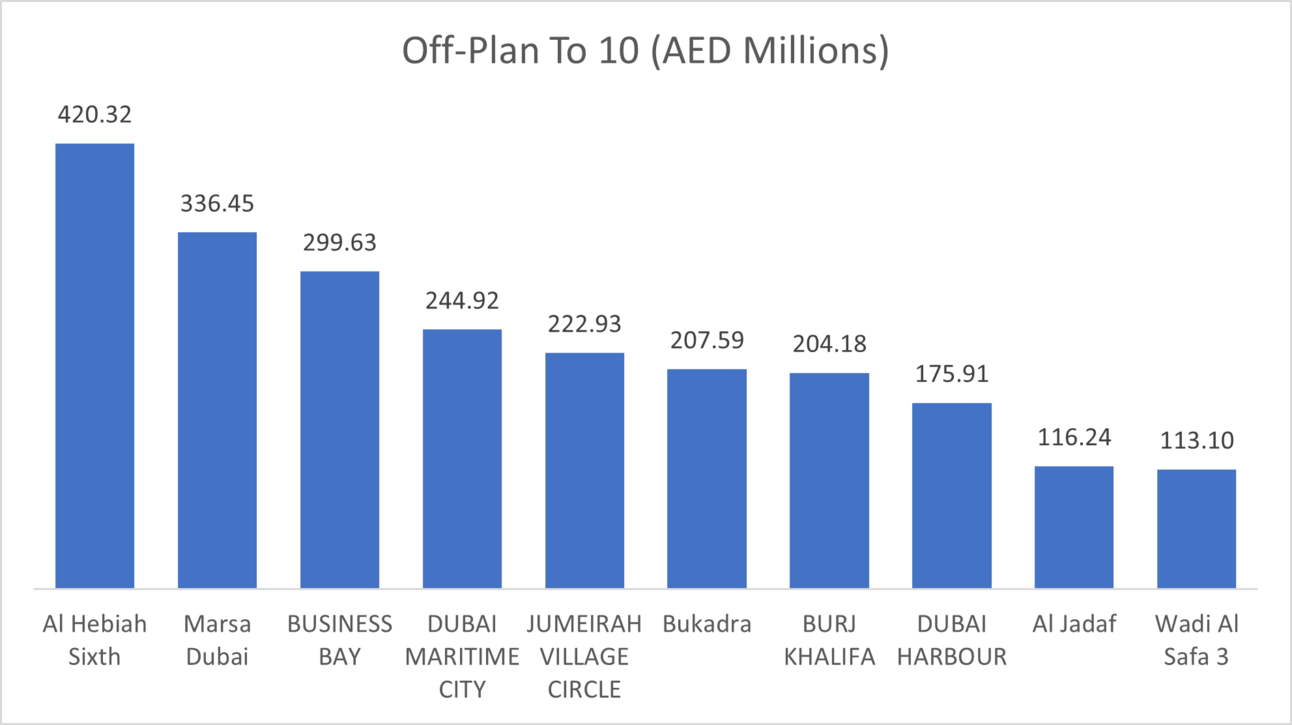

Top 10 Off-Plan Areas by Transaction Value:

Al Hebiah Sixth (Modon): AED 420,320,000

Marsa Dubai: AED 336,452,536

Business Bay: AED 299,632,760

Dubai Maritime City: AED 244,922,771

Jumeirah Village Circle: AED 222,925,584

Bukadra: AED 207,589,988

Burj Khalifa: AED 204,175,988

Dubai Harbour: AED 175,908,193

Al Jadaf: AED 116,238,116

Wadi Al Safa 3: AED 113,104,800

The off-plan segment is led by Al Hebiah Sixth, representing the highest individual area investment, indicating a bullish trend in newly developing regions.

Ready Property Transactions:

Ready properties contributed AED 3,105,703,542.84 to the total, representing approximately 43.6% of overall transactions. Within this category, flats again led with a total of AED 2,029,777,523.40, making up about 65% of the ready property transactions. Villas were also a popular choice, totaling AED 624,515,644.71, which is roughly 20% of the segment. Hotel apartments and rooms options had a share of AED 224,579,194.02, representing about 7% of the ready property sales. Commercial property transactions, which totaled AED 226,831,180.71, accounted for nearly 7% of this category.

Top 10 Ready Areas by Transaction Value:

Burj Khalifa: AED 310,610,389

Business Bay: AED 262,049,694

Jumeirah Lakes Towers: AED 216,019,415

Dubai Marina: AED 187,389,149

Jumeirah Village Circle: AED 178,010,457

Dubai Creek Harbour: AED 126,034,854

Palm Jumeirah: AED 110,323,743

Jumeirah Beach Residence: AED 109,740,346

Al Furjan: AED 75,771,164

Dubai Hills: AED 67,381,601

Notably, Burj Khalifa area ranks prominently in both off-plan and ready property transactions, emphasizing its iconic status and the high demand for luxury living. Business Bay and Jumeirah Village Circle are also common threads in both categories, indicating a balanced interest in both the present occupancy and future development potential.

Summary:

Dubai's real estate market showcases its rich diversity, attracting investment across a broad spectrum of property types and areas. From the emerging hotspots like Al Hebiah Sixth to the well-established luxury locales such as Dubai Marina and Palm Jumeirah, the investment flows remain dynamic. Apartments, leading the transaction volumes in both off-plan and ready sectors, underscore the city's strong demand for this property type, whereas villas continue to draw steady interest, appealing to those seeking family-centric living. Although hotel apartments and commercial spaces see more cautious investment, it reflects a market attuned to economic trends, indicative of investors' strategic positioning. Overall, the data paints a picture of a vibrant, multifaceted real estate landscape in Dubai, with a pronounced tilt toward residential investment, catering to the full range of investors and end-users—from those desiring the grandeur of luxury to those preferring the comfort of community spaces.

Data Source: Dubai Land Department