The Dubai real estate market has experienced a diverse week of transactions in Week 7 of 2024. The total value of transactions amounted to AED 5,161,508,379. This represents a downturn from the previous week's total of AED 6,045,750,062, indicating a 14.6% week-on-week decrease. The market split between off-plan and ready properties has shown significant activity in both segments, with a notable preference for flats in both categories.

Breakdown of Transactions:

Off-Plan Transactions: Total transactions for off-plan properties stood at AED 2,821,542,561. This segment is dominated by flat sales, contributing AED 2,399,137,143, which is approximately 85% of the off-plan total. Villas and Hotel Apartments & Rooms contributed AED 374,044,364 and AED 33,825,421, respectively.

Ready Property Transactions: The ready property segment saw transactions worth AED 2,339,965,817.85, with flats again leading the way at AED 1,600,161,601.59, or about 68% of the ready property transactions. Villas at AED 473,676,787.39 and Hotel Apartments & Rooms at AED 161,212,693.47 rounded off the rest of this segment.

Off-plan properties contributed approximately 54.6% to the week's total transactions, whereas ready properties accounted for the remaining 45.4%. This distribution underscores a healthy balance between new developments and existing property transactions.

Top 10 Areas by Transaction Value:

Off-Plan Top Areas:

Dubai Maritime City: Leading the off-plan segment with AED 405,818,991, this area highlights strong investor confidence in high-profile, waterfront developments.

Business Bay: With transactions totaling AED 277,867,587, Business Bay remains a hub for commercial and residential investments due to its central location and infrastructure.

Al Hebiah Sixth: Garnering AED 218,433,000, this district is likely benefiting from newer developments and strategic urban planning.

Al Wasl: A traditionally affluent neighborhood, saw off-plan transactions worth AED 195,376,000, indicative of its sustained desirability.

Jumeirah Village Circle (JVC): With AED 180,168,625, JVC continues to attract families and investors looking for a balanced lifestyle offering.

Dubai Creek Harbour: AED 163,501,487 worth of transactions showcases the area's growing appeal, particularly for those seeking a blend of modernity and culture.

Island 2: The transactions here amounted to AED 137,350,000, reflecting interest in Dubai’s visionary waterfront projects.

Palm Jumeirah: Iconic for its luxury offerings, it saw off-plan sales of AED 90,886,242, underlining its status as a high-end real estate hotspot.

Jumeirah Lakes Towers (JLT): AED 80,599,152 in transactions signals a consistent demand for this mixed-use community.

Al Merkadh: With AED 71,384,619, this area rounds out the top ten, possibly due to its location and investment potential.

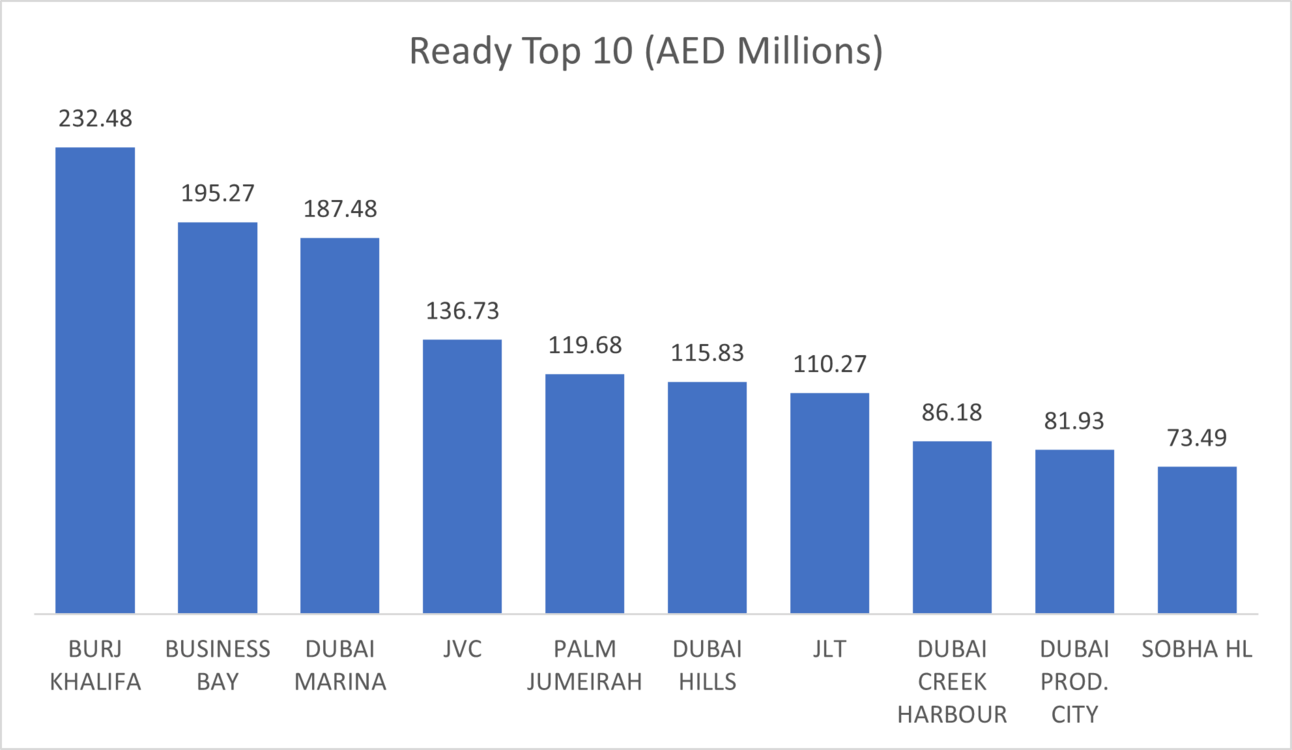

Ready Top Areas:

Burj Khalifa: The area surrounding this iconic structure saw the highest transaction value for ready properties at AED 232,478,403, underscoring its landmark status.

Business Bay: Featured again in the ready segment with AED 195,272,968, reflecting its versatility and appeal to a broad range of buyers.

Dubai Marina: A perennial favorite for its lifestyle offerings recorded transactions worth AED 187,478,177.

Jumeirah Village Circle (JVC): Echoing its popularity in the off-plan market, JVC's ready properties fetched AED 136,729,825.

Palm Jumeirah: Continues to be an investment magnet with ready property sales of AED 119,682,850, reaffirming its luxury market segment.

Dubai Hills: A relatively new development, it has quickly become a preferred area with transactions totaling AED 115,832,394.

Jumeirah Lakes Towers (JLT): Stands out in the ready property market as well, with AED 110,270,190, due to its strategic location and community feel.

Dubai Creek Harbour: Reflecting its dual appeal, it garnered AED 86,175,910 in the ready property space.

Dubai Production City (DPC): Highlighting its growing industrial and residential appeal with transactions worth AED 81,934,843.

Sobha Hartland (SOBHA HL): With AED 73,489,034, this area concludes the top ten for ready properties, likely due to its bespoke developments and strategic location.

The data suggests a balanced interest in both off-plan and ready properties, with a sustained appetite for flats across Dubai. The dip in week-on-week total transaction value could be an indicator of market correction or a temporary lull. The top areas by transaction value reflect the continued trend of investments in landmark locations and communities that offer a mix of lifestyle amenities and business opportunities.

Data Source: Dubai Land Department