This article was written by

Intro

REITs (Real Estate Investment Trusts) are companies that own, manage or finance income-producing real estate and then distribute the profits to shareholders in the form of dividends. Their main advantage is their high yield and liquidity compared to direct real estate investments.

A REIT (pronounced "reet") is like a backstage pass to real estate investing—no tenants, no repairs, just passive income. These companies own income-generating properties (think apartments, warehouses, or retail spaces) and are legally required to pay out at least 90% of profits as dividends. That’s why they’re a favorite for income-focused investors.

Why REITs rock:

High yields. By law, they must share the wealth.

Liquidity. Unlike physical property, you can sell shares anytime.

Diversity. Invest in anything from luxury apartments to Amazon warehouses.

But not all REITs are created equal. Some cut dividends when times get tough—others keep raising them year after year. Today, we’re spotlighting three elite performers:

Federal Realty (FRT) – The "Dividend King" with 55+ consecutive years of payout hikes.

Essex Property Trust (ESS) – A West Coast apartment powerhouse, rewarding shareholders for 28+ years.

National Retail Properties (NNN) – A retail REIT with 34+ years of growing dividends, backed by tenants like Walmart.

If you want real estate exposure without the headaches, these REITs deserve a look. Let’s break down what makes each one stand out.

Why Real Estate & REITs?

💡 Invest in companies you believe in - W. Buffett

Because while everyone’s obsessing over tech stocks and crypto, real estate keeps quietly printing money. Bricks and mortar don’t crash when the Fed tweets—they just collect rent. And REITs? They’re the cheat code: all the income of being a landlord, none of the midnight calls about broken toilets. We’re talking recession-resistant cash flow, decades of dividend hikes, and assets you can actually see—not just lines on a stock chart. In a world of speculative hype, REITs are the grown-ups in the room: boringly profitable, relentlessly reliable. That’s why we’re here.

Federal Realty Investment Trust (NYSE: FRT)

Federal Realty Investment Trust (NYSE: FRT) is a legendary real estate investment trust that has become the gold standard of stability and reliability in the U.S. commercial real estate sector. Founded in 1962, the company has built a unique portfolio of 102 premium properties, including flagship developments like Santana Row in California and Pike & Rose in Maryland. These mixed-use complexes combine retail space, restaurants, offices and residential units, strategically located in prime areas from Boston to Washington, as well as throughout Northern and Southern California.

FRT's Dividend Excellence:

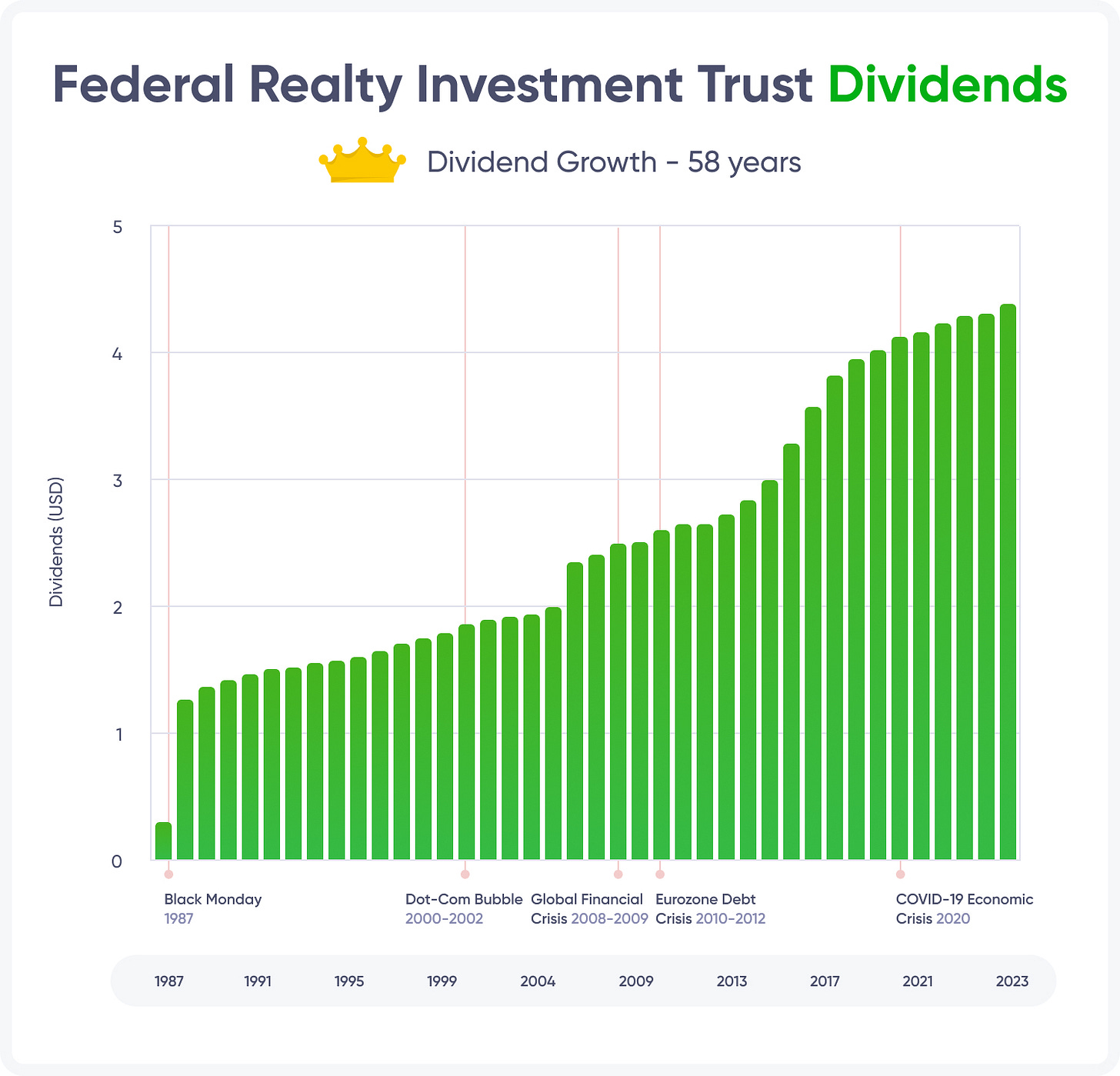

The company holds an absolute industry record, having increased dividends for 58 consecutive years, making it the undisputed "dividend king" of REITs. With a current dividend yield of 4.56%, payments are made on a stable quarterly basis. Most impressively, FRT has maintained dividend growth through every economic crisis - from the 1970s oil shock to the dot-com bubble and 2008 financial crisis.

Key Advantages:

Prime locations - all properties are situated in affluent coastal regions with high population density and purchasing power

Diversified tenant base - featuring resilient national chains like Trader Joe's, Apple, and CVS

Innovative approach - continuous property upgrades and unique retail-entertainment concepts

Financial strength - investment-grade credit ratings from major agencies

Success Story:

Over nearly six decades, FRT has evolved from a small retail property operator into an industry titan. The company hasn't just survived economic cycles - it has consistently grown asset value and dividend payouts. Its "trophy location" strategy has proven exceptionally effective, maintaining high occupancy and stable cash flow even during e-commerce disruption.

The Bottom Line: For conservative investors seeking reliability and steady income, Federal Realty Investment Trust represents one of the most attractive options in the REIT sector. This isn't just real estate investment - it's participation in a time-tested business model with an impeccable track record.

Company history

Federal Realty Investment Trust (NYSE: FRT) has a remarkable history that began in 1962 when it was founded by Samuel J. Gorlitz in Washington D.C. with just $2.3 million in initial capital. Starting as a small retail property investor, the company pioneered the REIT structure during its early years, becoming one of the first real estate investment trusts to go public in 1969. Over its 62-year history, FRT has transformed from a modest regional operator into a national powerhouse, weathering numerous economic cycles while consistently expanding its premium property portfolio.

The company's growth accelerated in the 1990s and 2000s with strategic acquisitions, including Del Mar Village in Florida (2008) and multiple properties in California and Maryland. A major milestone came in 2016 when FRT was added to the S&P 500 Index, cementing its status as a blue-chip REIT.

FRT's longevity stems from its early recognition of the value of strategically located retail properties in high-income areas—an investment thesis that has remained unchanged through decades of market evolution. This unwavering focus on quality locations and mixed-use development has allowed FRT to compound value for shareholders generation after generation.

Why invest in Federal Realty Investment Trust?

Federal Realty Investment Trust (FRT) stands out as a premier choice for investors seeking stable income, long-term growth, and recession-resistant real estate exposure. With an unmatched 58-year streak of consecutive dividend increases—the longest in the REIT sector—FRT has proven its ability to generate reliable cash flow through economic cycles. The company’s 4.56% dividend yield (paid quarterly) offers an attractive income stream, backed by a portfolio of 102 high-quality retail and mixed-use properties in affluent coastal markets like Washington D.C., Boston, and California.

FRT’s strategic focus on densely populated, high-income areas ensures strong tenant demand, with anchor tenants including resilient retailers like Trader Joe’s and Apple. Its mixed-use developments (e.g., Santana Row, Pike & Rose) combine retail, dining, and residential spaces, creating vibrant, destination-style communities that drive consistent occupancy and rental income.

Additionally, FRT’s investment-grade credit rating (A-/Baa1) and disciplined capital allocation support sustainable growth, while its S&P 500 inclusion (since 2016) underscores its blue-chip status. For investors prioritizing dividend longevity, premium real estate, and low-volatility returns, FRT represents a compelling long-term holding.

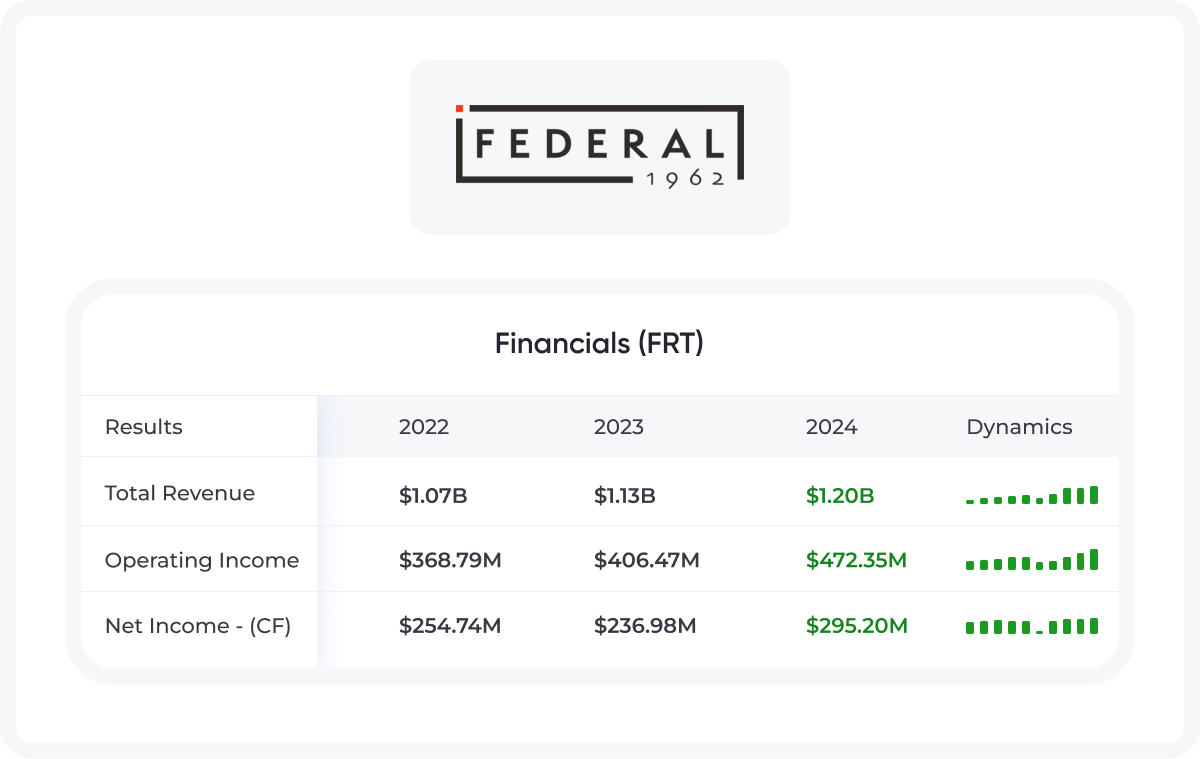

How do the financials stack up?

Here is a quick dive into Federal Realty Investment Trust over last 3 years

MaxDividends App: Federal Realty Investment Trust Financial Statement. Revenue.

Growth prospects

Federal Realty Investment Trust (FRT) is strategically positioned for sustainable growth through multiple avenues that leverage its core strengths in premium retail and mixed-use real estate. The company's growth strategy centers on three key pillars:

Strategic Redevelopment & Value-Add Projects

FRT continuously enhances its existing properties through thoughtful redevelopment, transforming traditional retail centers into modern mixed-use destinations. Projects like the expansion of Santana Row (adding residential towers) and Pike & Rose (incorporating office space) demonstrate how FRT maximizes asset value by adapting to urban lifestyle trends.High-Barrier Market Expansion

The company selectively acquires properties in affluent coastal markets with limited new supply, ensuring pricing power and tenant demand. Recent focus includes infill locations in Sun Belt cities and denser urban corridors where population growth outpaces retail development.Mixed-Use Dominance

By blending retail with residential, dining, and entertainment (e.g., Assembly Row near Boston), FRT creates "live-work-play" ecosystems that drive foot traffic and support higher rents. This model proves resilient against e-commerce disruption.

Competitive Advantages Fueling Growth:

Irreplaceable Locations: Properties in wealthy ZIP codes with high barriers to entry

Tenant Diversification: Balanced mix of necessity retail (grocers, pharmacies) and experiential concepts (dining, fitness)

Balance Sheet Strength: Investment-grade credit enables low-cost capital for growth initiatives

While precise growth rates depend on economic conditions, FRT's historical 3-5% annual FFO growth provides a reasonable baseline for future expectations, supported by:

Leasing spreads (renewals at higher rents)

Development pipeline ($500M+ in active projects)

Embedded rent growth in existing properties

For investors, FRT offers growth with discipline—a rare combination in REITs. Its focus on quality over quantity ensures durable cash flow expansion alongside its legendary dividend reliability.

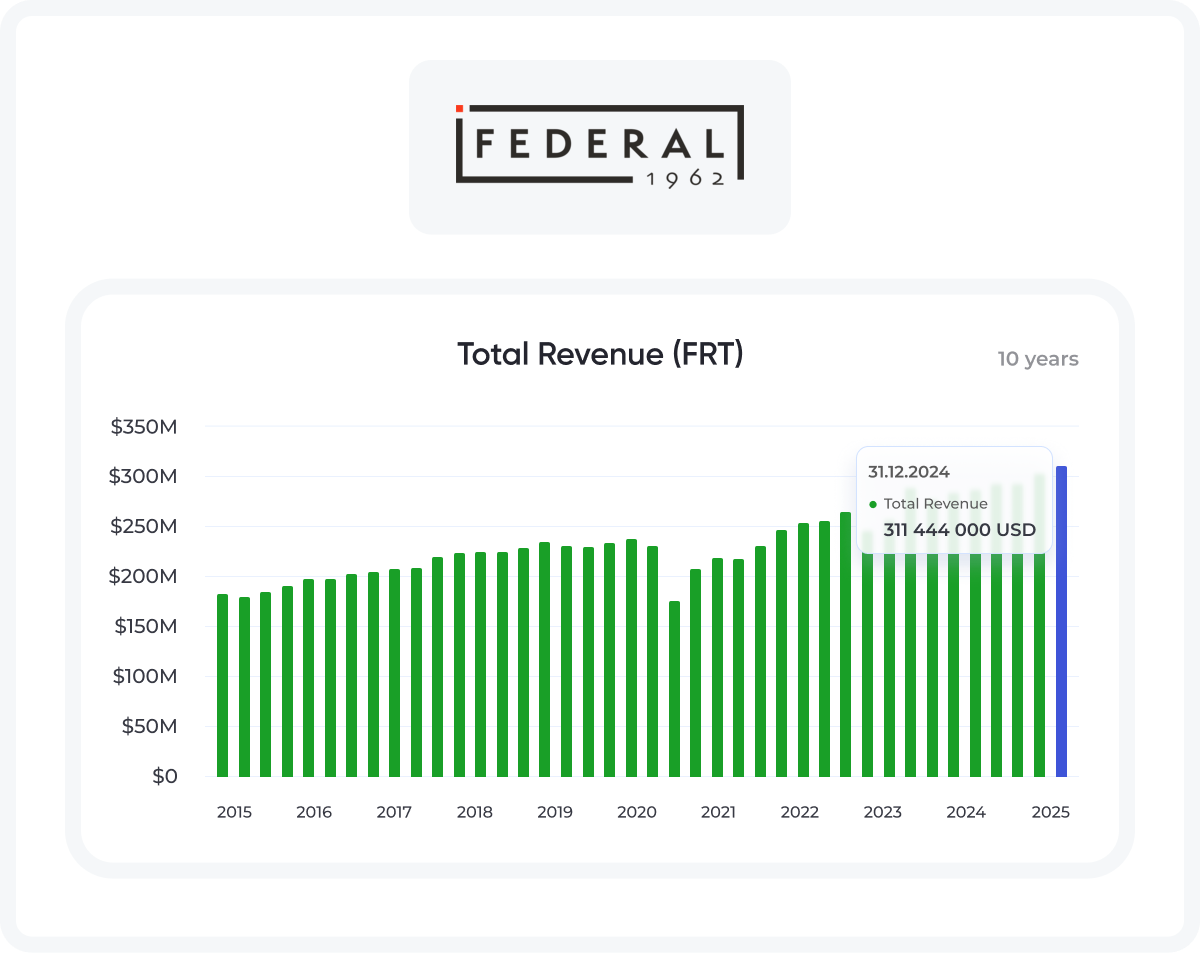

Current Dividend Yield 4.56% higher than 10 Years Average 3.53% Dividend Yield

Federal Realty Investment Trust Total Revenue over 10 Years

Essex Property Trust Inc (NYSE: ESS)

What is Essex Property Trust Inc?

Essex Property Trust, Inc. (NYSE: ESS) is a premier West Coast-focused REIT specializing in high-quality apartment communities, making it a standout in the residential real estate sector. As an S&P 500 company, ESS owns and operates over 250 apartment complexes across key coastal markets like Southern California, the San Francisco Bay Area, and Seattle—regions known for strong job growth, high barriers to new construction, and rising demand for rental housing.

Company history

Founded in 1971, Essex Property Trust has grown from a small California-based apartment operator into one of the nation's most respected residential REITs. The company went public in 1994 (NYSE: ESS) and has since expanded strategically across the West Coast's most desirable markets. Over its 50+ year history, ESS has weathered multiple economic cycles while consistently delivering value through its disciplined approach to acquiring and developing Class-A multifamily properties in supply-constrained coastal markets.

Today, Essex Property Trust stands as an S&P 500 company and a dominant force in West Coast multifamily real estate, owning and operating over 250 apartment communities across Southern California, the San Francisco Bay Area, and Seattle.

Why ESS Stands Out:

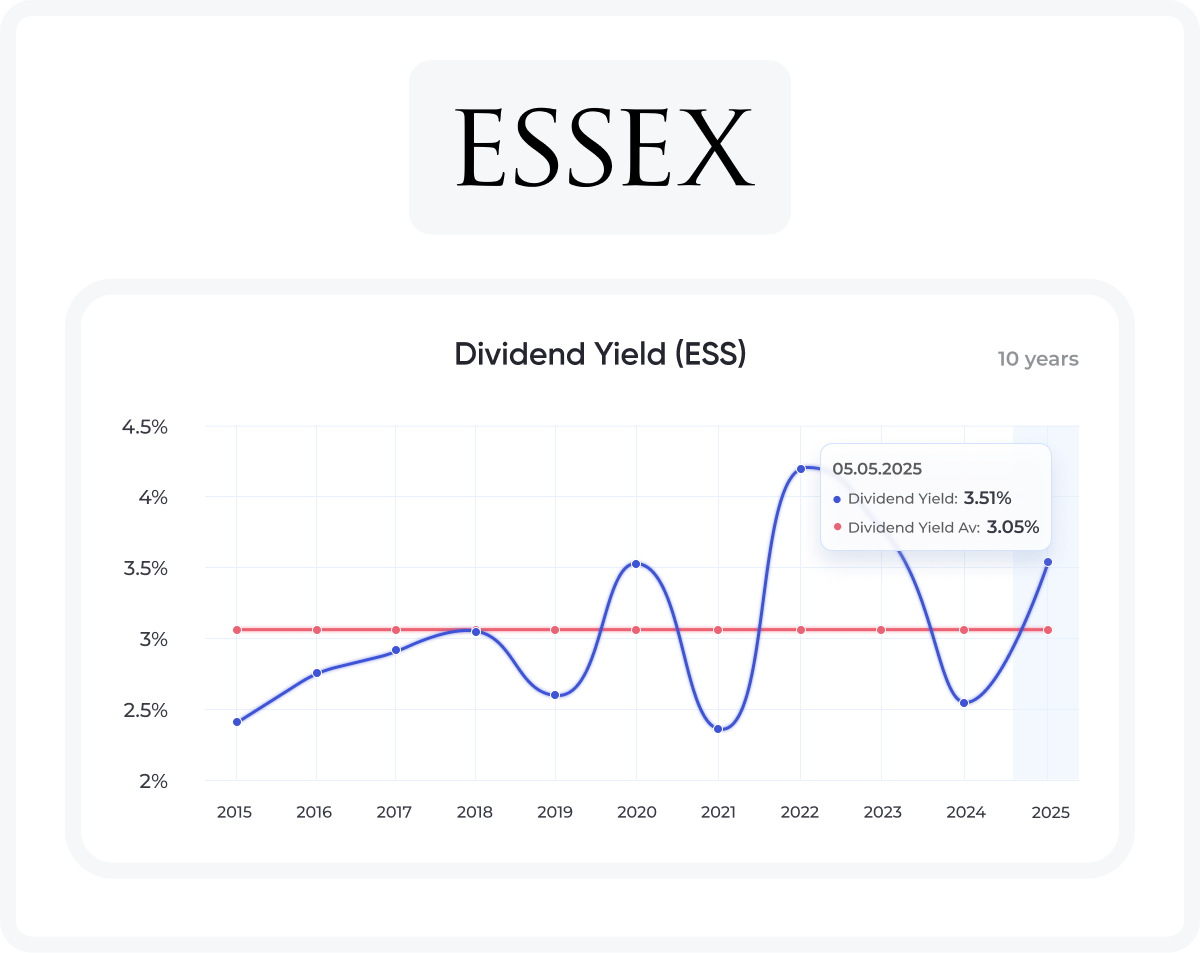

Dividend Aristocrat Status: With 29+ consecutive years of dividend increases, ESS is one of only a handful of REITs to achieve this distinction, offering a current yield of ~3.5%.

Rent Growth Power: Its focus on supply-constrained, high-income markets (e.g., Silicon Valley, Los Angeles) drives consistent rent growth and occupancy rates above 95%.

Resilient Business Model: Unlike retail or office REITs, ESS benefits from recession-resistant demand for housing, with long-term leases (typically 12 months) providing stable cash flow.

How do the financials stack up?

Here is a quick dive into ESS over last 3 years

MaxDividends App: Essex Property Trust Financial Statement. Revenue.

Why it matters: Revenue is one of the most important indicators of a company’s performance because it shows how much business the company is generating. A rising revenue trend means the company is growing, which can be a good sign for investors looking for stable returns. On the other hand, if revenue is stagnant or falling, it could signal challenges or shrinking market share.

Growth prospects

Essex Property Trust (ESS) is well-positioned for sustainable growth through its focused approach to West Coast multifamily markets. The REIT's expansion strategy leverages three core advantages:

Targeted Market Expansion

Concentrating on high-barrier coastal markets (California, Seattle) where limited housing supply meets strong demand from tech and professional tenants.Value-Add Investments

Modernizing properties with premium amenities and smart home technology to command higher rents while maintaining 95%+ occupancy rates.Strategic Capital Recycling

Selectively acquiring properties in growth submarkets while divesting older assets, maintaining portfolio quality.

ESS's competitive edge comes from:

Operational expertise in supply-constrained markets

29-year dividend growth track record demonstrating capital discipline

In-house development capability to create new inventory in sought-after locations

While specific growth projections vary, ESS's historical 4-6% annual rent growth in core markets provides a baseline for future performance, supported by:

West Coast population trends favoring rentals

Limited new construction in urban coastal areas

Tech sector employment growth driving demand

The REIT's balanced approach - combining organic rent growth with selective acquisitions - makes it a compelling choice for investors seeking both income and appreciation in residential real estate.

Current Dividend Yield 3.51% higher than 10 Years Average 3.05% Dividend Yield

Essex Property Trust Total Revenue over 10 Years

National Retail Properties Inc (NYSE: NNN)

National Retail Properties (NNN) has established itself as one of America's most reliable retail-focused REITs, specializing in single-tenant commercial properties leased under long-term triple-net agreements. With a portfolio of 3,641 properties across 49 states, NNN's assets include convenience stores, pharmacies, restaurants, and service centers occupied by recession-resistant tenants like 7-Eleven, Walmart, Dollar General, and LA Fitness.

The Bottom Line: NNN offers investors a low-volatility income play through its essential-service properties and dependable tenants. Its combination of high yield + dividend growth makes it ideal for income-focused portfolios.

Company history

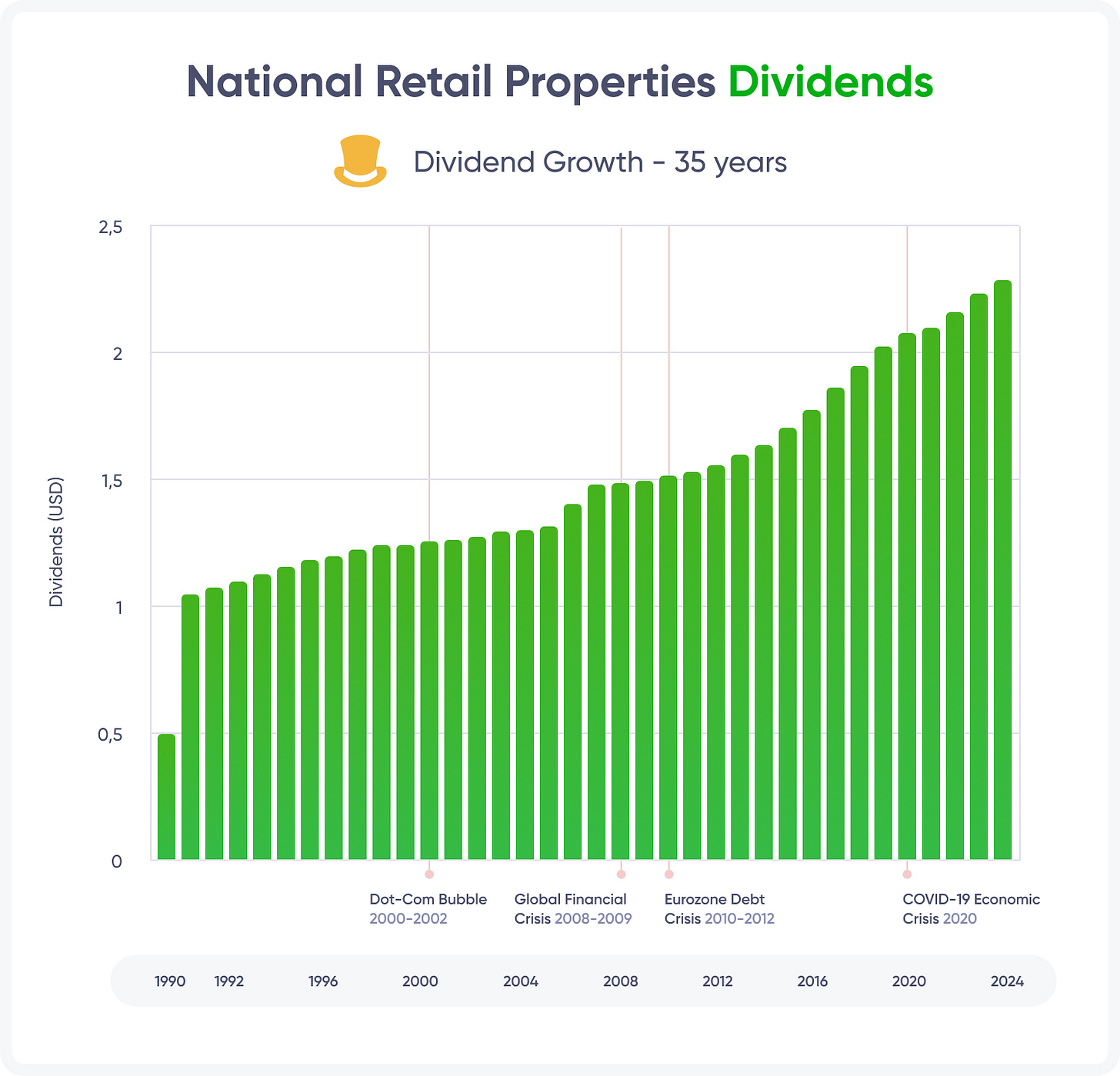

Founded in 1984 as a spin-off from commercial lender Commercial Net Lease Realty, National Retail Properties (NNN) began with just 137 properties but quickly established its niche in single-tenant retail real estate. The company weathered its first major test during the 1990-91 recession, emerging stronger by focusing on service-oriented tenants with recession-resistant business models. A pivotal moment came in 1998 when NNN adopted its current name and NYSE listing, followed by its inclusion in the S&P 400 MidCap Index in 2004. The REIT's disciplined approach was proven during the 2008 financial crisis, when it maintained dividend payments while peers cut theirs - beginning its remarkable 35+ year dividend growth streak. Over the past decade, NNN has strategically expanded into essential-service retail categories (convenience stores, auto maintenance, healthcare), with its portfolio growing from 1,800 properties in 2010 to over 3,600 today. This evolution reflects NNN's core philosophy: steady growth through economic cycles by owning mission-critical retail real estate.

Key Milestones:

1994: Initiated dividend growth streak

2008: Maintained dividend during financial crisis

2019: Surpassed 3,000 properties

2023: Achieved 34th consecutive annual dividend increase.

Why NNN Stands Out:

Dividend Aristocrat

35+ consecutive years of dividend increases – one of only three REITs with this distinction

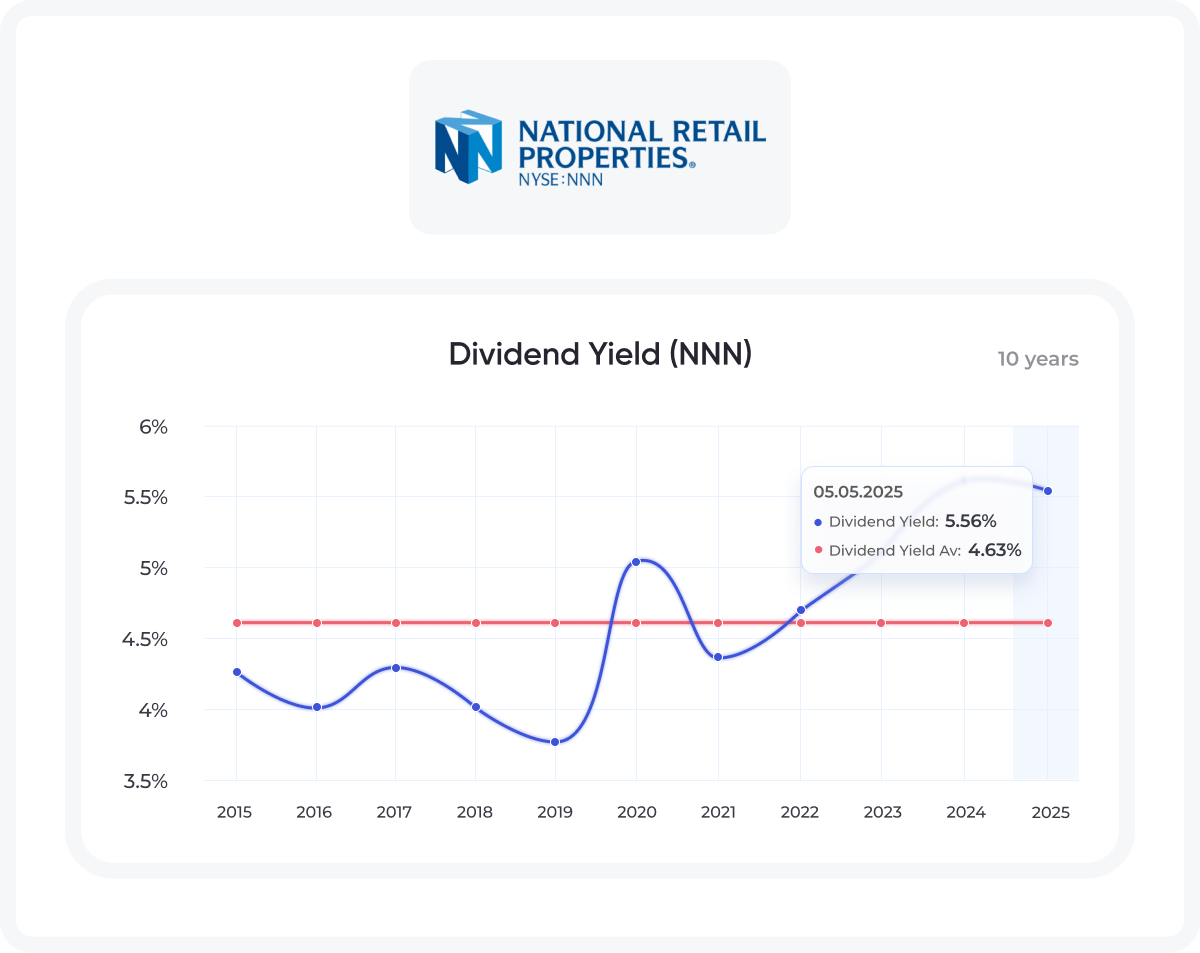

Current dividend yield of 5.56% ($2.32 annual payout per share)

Quarterly payments with a conservative 1.5x FFO payout ratio

Real Estate Strengths

97.7% occupancy rate (Q1 2025)

Average lease term of 10+ years ensures stable cash flow

Diversified across 37 industries, including pharmacies (16%), automotive services (12%), and restaurants (10%)

Financial Resilience

Investment-grade credit rating (S&P: BBB)

11.3% average annual total return over 30 years (with dividends reinvested)

Financial Statement

Here is a quick dive into National Retail Properties over last 3 years

MaxDividends App: National Retail Properties Financial Statement. Revenue.

Growth prospects

National Retail Properties (NNN) is strategically positioned for sustainable growth through its disciplined approach to single-tenant net-lease retail properties, focusing on essential-service sectors like convenience stores (16.7% of portfolio), auto services (12.5%), and quick-service restaurants (15.3%). The company’s growth drivers include:

Strategic Acquisitions

In Q1 2025, NNN invested $232.4 million in 82 properties at an average cap rate of 7.4%, targeting recession-resistant tenants in high-demand markets.

Full-year 2025 guidance projects 500–600 million in acquisitions, supported by a strong balance sheet with $1.1 billion in available credit.

Portfolio Optimization

Selective dispositions (e.g., selling 10 properties for $16 million in Q1 2025) to recycle capital into higher-yielding assets.

Maintaining 97.7% occupancy with long-weighted average lease terms (10+ years) ensures stable cash flow.

Rent Growth & Lease Management

5% year-over-year rent growth in Q1 2025, with lease renewals achieving a 98% recapture rate.

Embedded rent escalations (average 1.9% annually) provide organic growth.

Expansion into Emerging Retail Segments

Targeting omnichannel retailers and experiential concepts to mitigate e-commerce risks.

Exploring partnerships with dollar stores and pharmacy chains, projected to grow at 6.7% and 4.3% annually, respectively.

Financial Resilience

Core FFO growth of 3.6% YoY (Q1 2025) and AFFO of $0.87/share, supporting dividend sustainability.

Investment-grade credit rating (BBB) and low leverage (41.5% debt-to-capitalization) enable flexible financing.

Outlook: While cap rate compression poses a challenge, NNN’s focus on necessity-based retail, accretive acquisitions, and operational efficiency positions it for steady FFO growth (2025 guidance: 3.33–3.38/share). For investors, NNN offers a rare blend of high yield (5.56%) and 35+ years of dividend growth.

Current Dividend Yield 5.56% higher than 10 Years Average 4.63% Dividend Yield

National Retail Properties Total Revenue over 10 Years

Final Thoughts

In a world obsessed with fleeting tech trends and volatile crypto assets, REITs like Federal Realty (FRT), Essex Property Trust (ESS), and National Retail Properties (NNN) offer something increasingly rare: boring, predictable wealth creation. These three companies represent the gold standard of real estate investing, each with:

Decades of unbroken dividend growth (58, 29, and 35+ years respectively)

Fortress-like portfolios in recession-resistant sectors (mixed-use retail, coastal apartments, essential retail)

Yields ranging from 3.5% to 5.5%—far surpassing Treasury bonds and most dividend stocks

What makes them truly special is their dual engine of returns:

Income Stability: Their legally mandated 90% payout ratio turns real estate cash flows into reliable dividends.

Growth Potential: Strategic redevelopment (FRT’s Santana Row), tech-driven rent hikes (ESS in Silicon Valley), and accretive acquisitions (NNN’s $500M/year target) provide upside.

For investors, the lesson is clear: While trends come and go, well-located real estate—managed by disciplined operators—remains one of the few assets that can:

Pay you quarterly checks through market cycles

Grow your capital faster than inflation

Let you sleep at night without checking stock prices

As Warren Buffett famously said: "It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price." These three REITs—with their S&P 500 pedigrees, investment-grade balance sheets, and time-tested models—are precisely those "wonderful companies." Whether you’re a retiree seeking income or a millennial building wealth, they deserve a place in any diversified, long-term portfolio.

The numbers don’t lie: In a 60/40 portfolio world, adding REITs has historically boosted returns while reducing risk. Maybe it’s time to give bricks-and-mortar a seat at your investment table.

To your wealth, MaxDividends Team

Hundreds of paid subscribers

High-yield & dividend growth stocks worth investing in to boost passive income, live off dividends, and retire early.